|

|---|

|

| Store | company info | contact us | customer login | view cart |

Many people use the term "Adjust" whenever they refer to correcting mistakes.

In Industrial Strength Payroll, the term "Adjust" is used to mean fixing mistakes that do not affect the Net Pay. Choose Adjust when you need to move money from one field to another.

This section describes fixing errors that do not affect the Net Pay. If you need to correct an error that increases or decreases the employee's Net Pay, please go to the section called Correcting errors after a job has been closed.

The Adjust function is used to adjust the earnings, deductions or taxes. You are able to adjust within the earnings area, and within and between the deductions and withholdings. All adjustments to earnings must total zero. The totals of Taxes and Deductions must either be zero, or add up to zero (Taxes + Deductions = 0). The Net Pay must be zero.

Remember that any adjustment to Federal Income Tax, FICA, or Medicare will affect the client's tax deposit liability for deposit and 941 purposes.

For example, employee Smith had earnings of $250.00 recorded as Regular Pay, when it should have been Holiday Pay. Also, a one-time local head tax of $15.00 needs to be moved from a deduction called Other into the City field.

To correct this error,

Click the Calculations link (if necessary).

Click Close this Job.

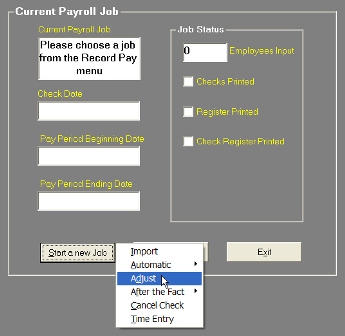

Click Start a new Job.

Choose Adjust from the pop-up menu.

Enter the dates for this transaction.

Ignore the Hash Total entry screen. Since all values must balance out, the concept of Hashing doesn’t apply to Adjust.

Retrieve employee Smith.

Start with the income. Click on the Amount column beside the Regular income label.

Type -250.00 and press <Tab>.

Click on the Amount column beside the Holiday label.

Type 250.00 and press <Tab>.

Note that the Total Earnings field is zero.

Now move the deduction. Click on the column beside the Other deduction label.

Type -15.00 and press <Tab>.

Note that the Total Deductions is -15.00 and the Check Amount is negative.

Click on the column beside the City Tax label (the label will contain the name of the City).

Type 15.00 and press <Tab>.

Note that the Total Taxes field reads 15.00, and the Check Amount is zero.

Carefully verify the entries.

If correct, click the Compute button.

Click the Post button to save the adjustments.