|

|---|

|

| Store | company info | contact us | customer login | view cart |

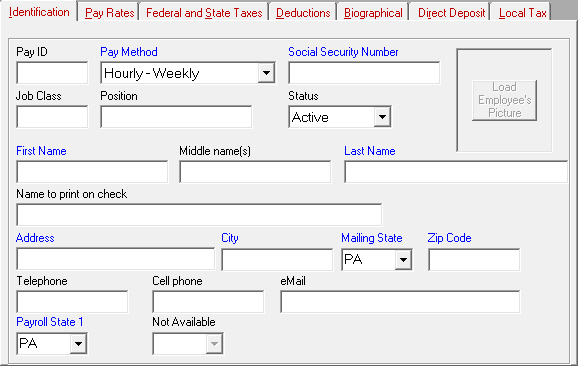

This is the Employee Identification tab

Here's how to complete this screen:

The Pay ID is an optional 5-digit identifier. It may range from 1 to 32,000 and must be unique. It may be zero. We recommend you use this feature.

The Pay Method determines how the employee is processed, and how taxes are computed. The available methods are:

For W-2 employees:

Hourly - Daily

Hourly - Weekly

Hourly - Biweekly

Hourly - Semi-monthly

Hourly - Monthly

Salaried - Weekly

Salaried - Biweekly

Salaried - Semi-monthly

Salaried - Monthly

For 1099 employees:

1099 - SSN - A 1099 recipient using their Social Security Number.

1099 - FEIN - A 1099 recipient using a Federal Taxpayer Identification Number.

1099 - ITIN - A Foreign National using an Individual Taxpayer Identification Number.

For third parties:

3rd Party - Other people you want to pay using this program. 3rd parties do not receive a W-2 or a 1099-MISC.

The Social Security Number label changes to FEIN, ITIN or nothing depending on the Pay Method.

You may enter 000-00-0000 if the Social Security Number is unknown. FEIN’s and ITINs are checked using the applicable standards of the IRS.

The Job Class field has two purposes. The first is to hold the 4 digit National Council on Compensation Insurance Code for the type of work performed by this employee. Industrial Strength Payroll uses this number to group the Earnings Report.

The second is to hold a classification code used by the Company Profile report.

There are 3 available Status states for an employee:

Active,

Terminated, and

Idled (Laid off).

The First Name, Middle name, and Last name of W-2 (regular) employees and 1099 recipients who use their SSN’s should be exactly as they appear on the employee’s Social Security Card. This makes it easier for the Social Security Administration to pair the names with the Social Security Number when posting the earnings and contributions to the employee’s social security file. If you omit the middle name, or use an alias such as Jimmy instead of James, the SSA might have to write you for clarification. At worst, you might be subject to fines for reporting incorrect information on Form W-2.

To allow for those many cases where a person is known by something other than his full legal name, we have introduced the Name to print on check field. This fills automatically with the legal names, but you can change it to read anything you want. So if James Robert Smith wants to be known as Jim-Bob Smith, you can accommodate his needs.

For other 1099 recipients, and 3rd parties, try to fit their name into the name fields in a way that you will recognize on reports. The First name and Last name must have something in them. Then write the name the way it actually is in the Name to print on check field.

Payroll State 1 is the employee’s state for Income Tax purposes. Normally, SUTA is accrued for this state as well. Please see Multi-state employees for other situations.