|

|---|

|

| Store | company info | contact us | customer login | view cart |

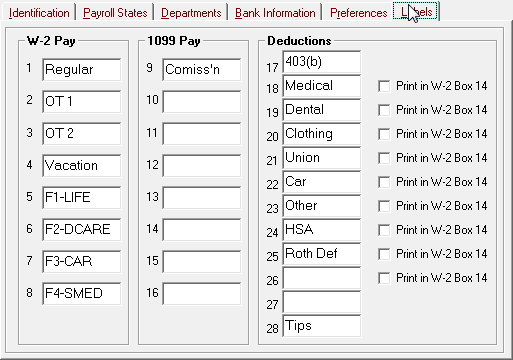

Industrial Strength Payroll has 16 income labels, 8 for regular employees, and 8 for 1099-MISC recipients. Every income label can have a rate associated with it in the Employee Master file. When a label is not blank, the contents of that field become visible both literally and figuratively. Blank labels are omitted from all reports and all calculations. The space they would normally occupy on input screens is blank and the cursor doesn't stop.

However, all non-zero amounts print in the registers, whether or not a label exists.

Some features of Industrial Strength Payroll, such as fringe benefit recording, require certain labels.

For one-state employees, those whose Master Record has a blank in Payroll state 2, there are 8 income labels for regular pay, and 8 for 1099 pay.

For two-state employees, those whose Master Record has a state in Payroll State 2, labels numbered 1 to 4 and 9 to 12 apply to Payroll State 1. Labels numbered 5 to 8 and 13 to 16 apply to Payroll State 2.

All employees in a Client have the same 12 deduction labels.

When you create a new Client, these labels are created by default:

Change any label by clicking on it and typing in whatever you want. To blank a label, click on it, then press Delete.

The Print in W-2 Box 14 checkboxes beside the Deductions column are used when preparing W-2 forms. Please click here for more.