|

|---|

|

| Store | company info | contact us | customer login | view cart |

Every quarter we get calls from people who are confused between reporting liability and deposits on forms 941. They believe they will get in trouble with the IRS if they do not report actual payments they have made in the sections that are used for reporting liability, especially when that section is left blank. Here is some clarification.

Part 1 of these forms is a summary of your payroll for the period. In it you report how much you paid your employees, how much tax you withheld, taxable wages for other employment taxes, the tax on them and any adjustments.

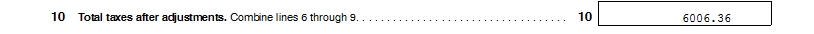

At the end of that list is a Total line. This is your total liability for the period.

(example taken from Form 941 - 2014)

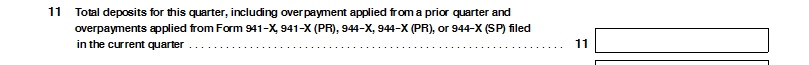

Payments are recorded right after that.

(example taken from Form 941 - 2014)

This is the ONLY place on the form that is used to record payments you have made for the period. Note that only the Total is recorded. There is no breakdown of deposits by date. IRS gets those details elsewhere, presumably the EFTPS system.

Liabilities are reported in Part 2: Tell us about your deposit schedule and tax liability for this quarter. Semi-weekly deposit schedule employers also supply a schedule such as Schedule B (Form 941).

And, you may not have to report them at all.

The IRS establishes thresholds for liability reporting on 900-series forms. Consider this segment from Form 941 (2014), Part 2, page 2:

(example taken from Form 941 - 2014)

The area highlighted in YELLOW clearly shows that liability is only to be reported if the Total taxes after adjustments from Part 1 is $2,500.00 or more. (Forms 940, 941-SS, 943 and 944 all have thresholds.)

Industrial Strength Payroll knows and follows these rules. If the Total taxes after adjustments from Part 1 does not meet the threshold, the liability and deposit schedule are not supposed to be reported and the program won't let you.

Now suppose your Total taxes after adjustments from Part 1 is over the threshold but the software still won't report it. This is perfectly normal if yours is a seasonal business, or one that is growing rapidly.

Please look at the area highlighted in GREEN. This means that you do not have to report liabilities if the preceding Quarter was beneath the threshold, and you did not incur any $100,000 next-day deposit obligations.

Industrial Strength Payroll knows your Total taxes after adjustments from Part 1 for the prior quarter. If they were under the threshold, you are not supposed to report the current period values and the program won't do it.

In all other cases you do have to report both your liabilities and deposit schedule as applicable.