|

|---|

|

| Store | company info | contact us | customer login | view cart |

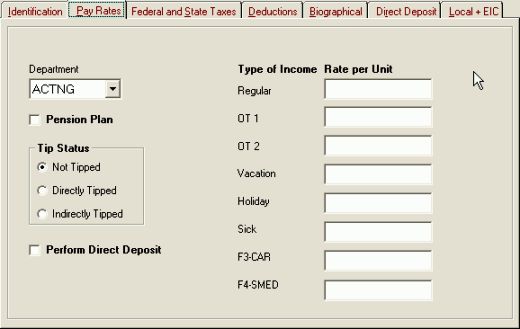

This is the Pay Rates tab.

Here’s how to complete this screen:

The Department selection shows the department codes that are in the Client file for this client. An employee can be attached to one department throughout the year.

Check the Pension Plan box if the employee has any type of pension at all and you want to have the W-2 reflect that fact. The Pension Plan box must be checked for an employee to participate in any of the supported deferred compensation plans.

Click on the appropriate Tip Status.

Check the Direct Deposit box if the employee wants his paycheck deposited directly. The Client must first be set up for Direct Deposit.

Every employee can have up to 8 different pay rates.

For salaried employees, the first box in the Rate per Unit column must represent 1 standard pay. That is, 1 week if the employee is Weekly, 1 month if Monthly, and so on.

For Hourly or Piecework employees, enter the value of one unit.

Industrial Strength Payroll multiplies anything you enter in the Hours column of Calculations with whatever you enter in the Rate per unit when calculating payroll. Therefore, the entries you make here can represent anything you want them to. They could be a shift premium, an overtime rate or the value of picking a box of avocados.

Pay special attention to the entries for multi-state employees. The first 4 Rates apply to Payroll State 1. The last 4 apply to Payroll State 2. Your income labels should reflect this.