|

|---|

|

| Store | company info | contact us | customer login | view cart |

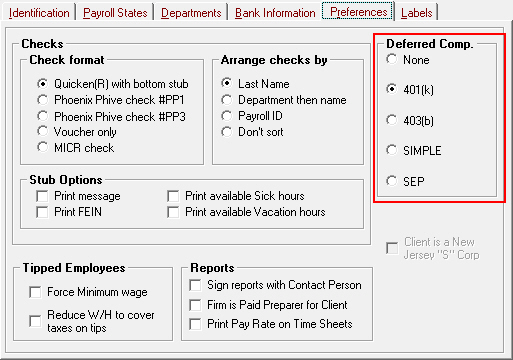

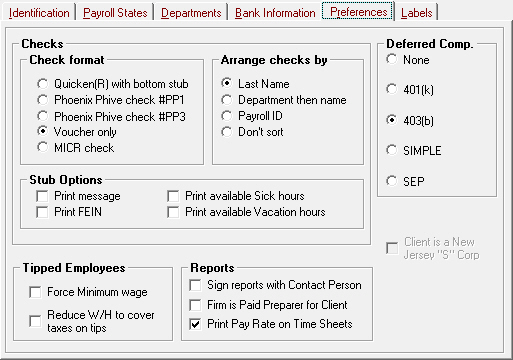

This tab sets many of the options for this Client.

Here’s how to complete this screen:

The Checks area is where you choose the type of check, how you want them to be sorted, and options for the check stub.

Select a style from the Check Format section. The available styles are:

Business-size QuickBooks® format PPQ3L1 with the check on top and two blank vouchers.

Complete current and YTD information is printed on a Phoenix Phive PP1L1 laser check with preprinted top stub and blank bottom stub.

Complete current and YTD information and associated titles are printed on a Phoenix Phive PP3L1 laser all purpose check that has a blank stub on top and bottom.

The Voucher Only option produces vouchers to give to your employees using Phoenix Phive VOUCHERCONT (dot matrix) or tri-perforated VOUCHERLASER.

Checks can be sorted in 4 different ways. Choose the one you prefer from the Arrange checks by section. The Don’t sort option results in checks being printed in the order that the employees were entered into the Employee Master file.

In the Stub Options area, choose any of:

Print message causes Industrial Strength Payroll to stop before printing and request a message to print on the check stub or voucher.

Print FEIN prints the Client’s FEIN on the check stub. This is required of certain agricultural employers.

Print available Sick Hours and Print available Vacation hours causes the selected item to be printed in the message box on the check stub or voucher.

The section on Tipped Employees offers 2 options:

Click on Force Minimum wage to have Industrial Strength Payroll add enough wages to the employees’ earnings so that they are paid at least the Federal Minimum Wage as stored in the Tax Table. Industrial Strength Payroll computes the hourly rate after allowing for tips deemed wages. If it is below the Federal Minimum wage, Industrial Strength Payroll adds the required difference in Income field #8.

Sometimes there are insufficient cash wages and charge tips to pay the required withholdings. By checking Reduce W/H to cover taxes on tips, you tell Industrial Strength Payroll to reduce first Federal, then State and Local withholdings enough to achieve a zero-balance check, if possible. FICA and Medicare are not changed.

The Reports area sets options for Form 941 and other reports.

Click on Sign reports with Contact Person and Industrial Strength Payroll inserts the Contact Person’s name and title if the report has room for it, into the report.

Firm is Paid Preparer for Client is replaced by an entry in the Firm file.

Click on the appropriate selection in the Deferred Comp Area.