|

|---|

|

| Store | company info | contact us | customer login | view cart |

There are many occasions where you may want to be able to separate Clients for payroll operations, and merge them for reporting purposes.

One such occasion arises when a company operates in more than 3 states. You must make several instances of the Client to accommodate the separate states, yet you probably want to file a single 941 for the group.

Or you might operate several stores or restaurants and want to keep the books separate to be able to better judge their individual performance.

Industrial Strength Payroll can consolidate Clients for reporting purposes. All Clients must use the same FEIN for this to work.

On demand, Industrial Strength Payroll creates a special Consolidated Client whose number is 999. This special Consolidated Client is static, meaning that any changes you make to it do not get passed to the individual underlying Clients. In a like vein, any changes you make to the underlying Clients are not automatically carried to the special Consolidated Client.

Another thing to remember is that there can only be 1 special Consolidated Client. This means that, in the case where you have more than 1 Client group, every new consolidation replaces the existing one.

How to make a special Consolidated Client

Choose one Client to be the Headquarters Client.

Make that Client the Current Client.

Choose Reports | File | Consolidate.

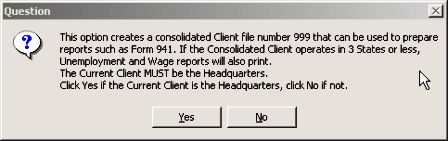

Answer this question.

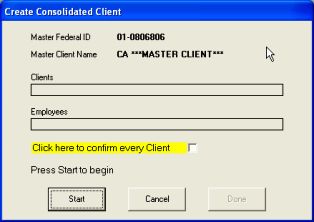

Click Yes to see the Create Consolidated Client screen.

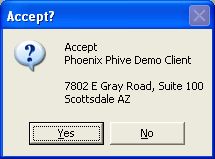

Note the highlighted area. Industrial Strength Payroll offers you the means to choose which members of the group to include in the consolidation. You might want this feature to print reports for a subset of your main group. Check this box and the next window appears for every consolidation candidate.

Click Done when it becomes available.