|

|---|

|

| Store | company info | contact us | customer login | view cart |

A W-2 edit file is created the same way that conventional paper W-2’s are and contains exactly the same information arranged the same way, in ascending Social Security Number order.

You can create a W-2 Edit file as often as you like. So, in the case that you make some catastrophic error and want to start over, you simply delete the old W-2 Edit file, and create a new one.

There are some very important side effects you should consider before deciding to edit your W-2's.

You cannot e-file edited W-2s at the Federal or State level.

The W-2 Editor doesn’t interact with your general payroll files in any way at all. Anything you do to the W-2 Edit file will not be reflected in any other reports. They do not carry onto Form 941, Form 940 or anywhere else.

Underlying data such as employee identification information is not updated if you change it using the editor.

Anything you change in the underlying payroll data will not be reflected in the edited W-2s.

Changes you make are not permanent. They only last for as long as the Edit file exists. If you decide to delete it, your only recourse is re-entering the changes in a new edit file.

Edited W-2s are printed from a different area in the software. Clients with edited W-2 files do not appear in the same box as Clients with unedited forms. You may think that you have "lost" clients.

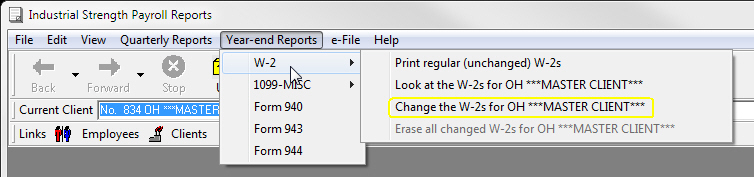

Choose Reports then Year-end Reports.

Hover over W-2 then click on Change the W-2s for [current client].

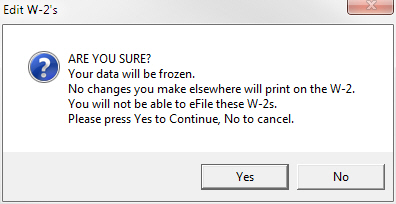

Acknowledge the warning.

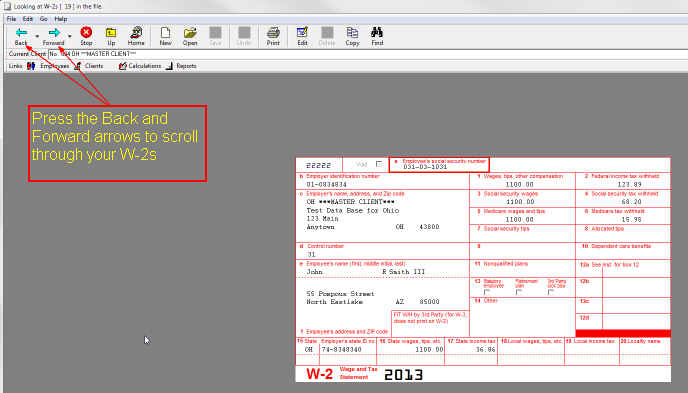

A blank W-2 appears on the screen.

Click the Back arrow to view the first W-2.

Navigate between the W-2s as directed in this image.

You can change any of the information in Boxes 1 through 22 using the W-2 Editor. The Editor is free form and makes no assumptions about what you should be putting in a given field. It is especially important to remember this if you make any changes to Box 12. All items in Box 12 must have an alpha code letter. The proper letter for a particular item, like 401(k) deferred compensation, is set forth in the annual instructions issued by Social Security and the IRS.

The editor does test FICA and Medicare wages and withholdings, but you can ignore the warning messages and force the W-2 to print the way you typed it. We do not recommend ignoring any warnings. Fines and penalties for filing incorrect W-2’s range up to $100.00 per W-2!

To change a W-2:

Use the Back or Forward arrows, the Open button, or the Find button to find a W-2 for the employee.

Press the Edit button.

Navigate to the field you want to change.

Make the change and press <Tab>.

Press the Save button when done with that W-2.

Click Stop when you’re done editing W-2’s.

Click Print to print them.