|

|---|

|

| Store | company info | contact us | customer login | view cart |

As discussed earlier, the liability values come directly from your payroll activity. There should be no need to change them under normal circumstances and we caution you to use great care. Please try to correct the underlying data using the error correction procedures in order to avoid issues reconciling your W-2s.

In the case of Form 940, please do not correct Q1 through Q3 liabilities to reflect a Credit Reduction. The liability for Credit Reduction occurs in the 4th Quarter.

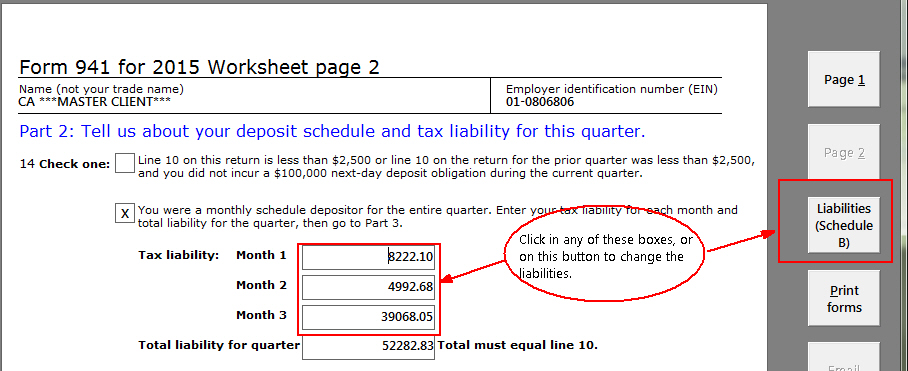

For the 941 family of reports, all corrections, regardless of your deposit schedule, are made on the Daily liability schedule (Form 941B) page.

Click the 941 B button when Page 2 is on-screen.

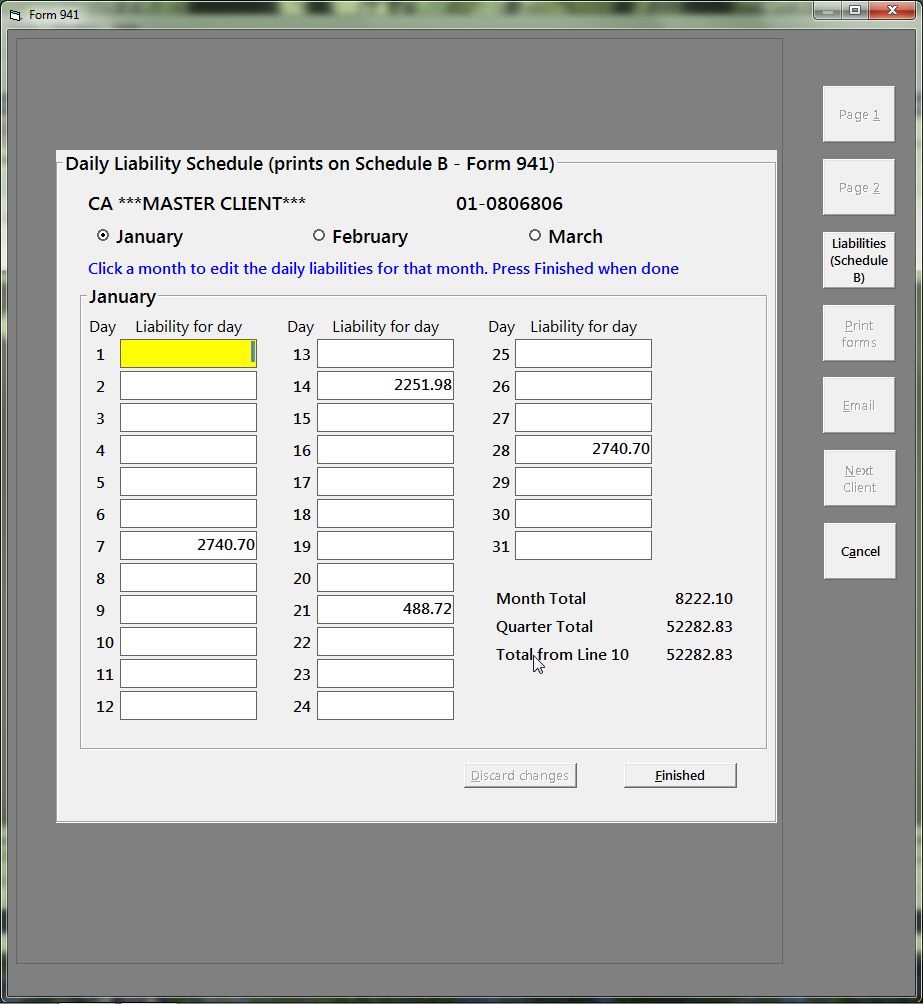

The Daily Liability Schedule window appears.

Then click on one of the three months to bring it into focus, and then the day of the month that you want to edit. It turns yellow as demonstrated.

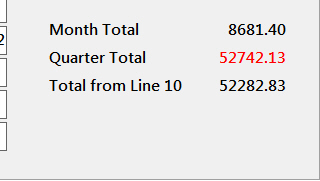

The software gives you a running comparison between these values and your actual liability for the period as shown on Line 10.

If the liabilities do not match the total from page 1, they appear in red.

Click on Finished when you have completed your changes, or Discard changes to exit without changing anything..