|

|---|

|

| Store | company info | contact us | customer login | view cart |

A Client can have taxes withheld or accrued for up to 3 different states. This section provides definitions of the states for which this Client is reporting payroll. No state needs to be the same as the Client’s home state. Employees can only have taxes withheld or accrued for states that appear here.

If a Client needs to be able to withhold and report for more than 3 states, set him up under as many client numbers as you need to accommodate his needs.

When it comes time to create reports such as Form 941, create a consolidated Client to group all of the clients together for the purposes of preparing the report.

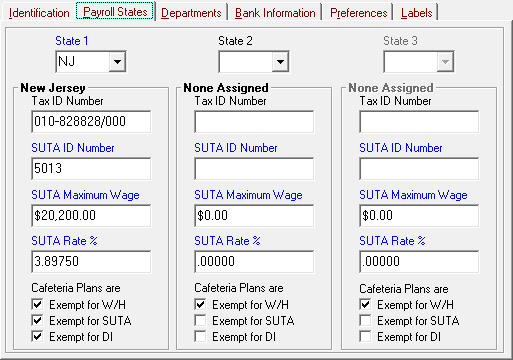

This is the Payroll States tab.

Here’s how to complete this screen:

Type the state postal code, or press the down arrow to select a state from the State 1 box. (The Client’s mailing state is the default.) The name of the state now replaces None assigned.

Enter the Client's State Tax ID number, if applicable. Try to maintain the formatting that is used by the state, including spaces. If there’s not enough room, remove spaces, dashes, and other punctuation.

Enter the SUTA ID Number. This field is required. Try to maintain the formatting that is used by the state, including spaces. If there’s not enough room, remove spaces, dashes, and other punctuation.

Enter the SUTA Maximum Wage and SUTA Rate % from your files. Remember to enter the rate as a percentage (e.g. 5.85%) , not a multiplier (e.g. 0.0585)

Note for New Jersey Clients.

Enter your NJ Registration number with no punctuation plus /000 (e.g. 123456789/000) in the State Tax ID.

Enter the 4-character Alpha Code that New Jersey has assigned to this client in SUTA ID Number. Alpha codes print beside the Registration Number on most forms you get from the state. An alpha code usually is the 1st 4 characters of the client's name.

The last part of each state is where you define the tax status of contributions to §125 Cafeteria Plans for:

State Tax Withholding – W/H,

State Unemployment – SUTA, and

State Disability – DI.

The default is Taxable for all 3 taxes. To exempt plan contributions from a specific tax, just click on the label. A check mark or an X shows beside any exempt tax.

Repeat for States 2 and 3 if needed. Note – States must be assigned in order.