|

|---|

|

| Store | company info | contact us | customer login | view cart |

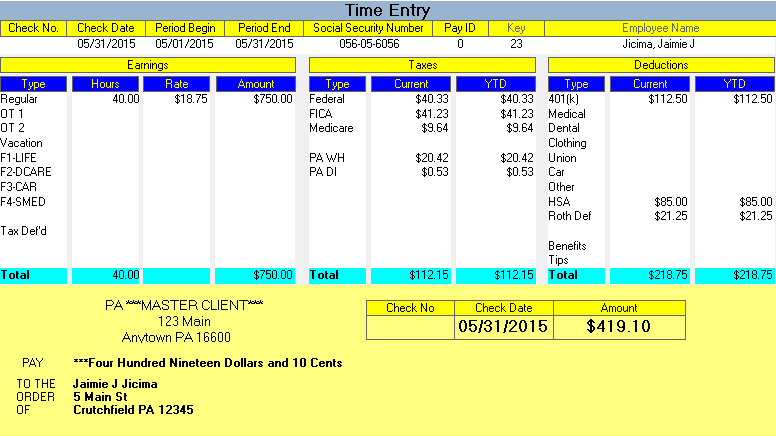

The Payroll Recording Window is the doorway to all of your payroll data. Everything that affects your employees earnings, taxes and deductions comes through here. It is made to look like a standard PP1 paycheck from Phoenix Phive.

It is divided into 3 principal sections, Earnings, Taxes and Deductions. The Earnings section shows only the current values. The Taxes and Deductions sections show YTD values as well as the current amounts.

For employees who receive income from 2 different states, State 1 appears in black, and State 2 is blue. The state codes are appended to the income labels as a further aid. The first 4 Earnings apply to State 1, and the last 4 to State 2.

In a similar fashion, the first Locality is in black, and the second is blue.

There are 2 Earnings fields that are non-standard. They are:

Tax Def’d (= Tax Deferred Pay): This field is intended for those cases where you do not want to have taxes withheld from otherwise taxable income. FICA and Medicare will always be deducted. Money recorded here will be reported as income on Form 941 and Form W-2. DO NOT USE THIS FIELD FOR REIMBURSEMENTS. This field is called TDW if the employee is tipped.

Tips: Records tips reported by tipped employees. The program will automatically divide reported tips into Tips and Tips Deemed Wages = TDW. TDW is used for Minimum wage calculations, and is the value to use when claiming Credit for Employer Social Security claimed on IRS Form 8846. Amounts you enter are deducted in the Tips deduction.

Please read The Payroll Recording Process for more.