|

|---|

|

| Store | company info | contact us | customer login | view cart |

Reporting 3 local taxes for the same employee

There is only room for 2 local taxes on Form W-2. The instructions say to issue another W-2 to report the extra locality. Here's how...

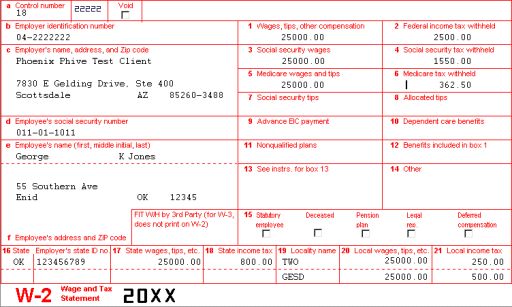

Mr. Jones moved from Ada to Enid during the year. Both cities impose a 1% income tax. He is also subject to the Greater Erie school district tax of 2%. You need to show each amount on a W-2.

When he moved, you changed the name of his Locality #1 field from Ada to Two to remind you that there were 2 localities in that field. You also recorded his YTD Local Wages and Local Withholdings at that time.

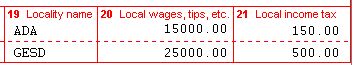

You need to report the following on his W-2:

Locality |

Wages |

Withholdings |

Ada |

15,000.00 |

150.00 |

Enid |

10,000.00 |

100.00 |

GESD |

25,000.00 |

500.00 |

This is easy. Here’s how:

Create a W-2 Edit file (if you haven’t already done so).

Press Edit.

Go to Box 19.

Change the entry to Ada.

Go to Box 20.

Change the value to 15000.00.

Go to Box 21.

Change the value to 150.00.

Click Save.

Mr. Jones’ W-2 is still on the screen.

Press Copy.

A new W-2 with blank boxes 1-21 appears.

Go to Box 19.

Type Enid.

Go to Box 20.

Enter 10000.00.

Go to Box 21.

Enter 100.00.

Click Save.

Click Stop.

Now there are 2 W-2’s for Mr. Jones.

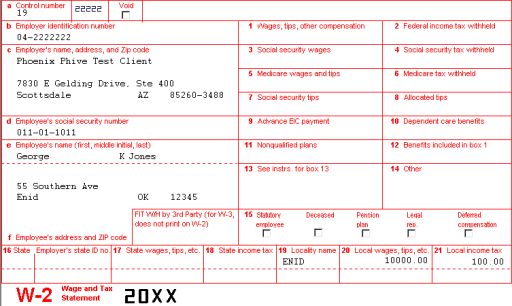

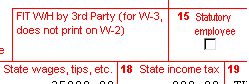

Reporting 3rd-Party FIT on Form W-3

Ms. Smith was disabled in an on-the-job accident. She received income from the state disability fund. The state withheld $76.38 FIT but you are required to report it on Form W-3.

Industrial Strength Payroll has a special box for 3rd party FIT in the W-2 Edit. Any money entered there is automatically placed on Form W-3. To record money there:

Create a W-2 Edit file (if you haven’t already done so).

Press Edit.

Go to the box labeled FIT Withheld by 3rd Party.

Type 76.38.

Press <tab>.

Press F10 or

Click Save to save the changed W-2.