|

|---|

|

| Store | company info | contact us | customer login | view cart |

Many people who live in bordering states are affected by reciprocity agreements whereby income taxes are withheld for their state of residence, and unemployment insurance is accrued in the state that they work in. Industrial Strength Payroll easily handles such situations. Here’s how:

Both states must be established in the Client Master Record for that client. They can be in any order. To establish the states follow this link...

Next, set up the employee.

Click on the Employees link.

Choose File | Open from the menu, or click on the Open button.

Choose File | Open from the menu, or click on the Open button.

In the Identification tab, set Payroll State 1 to the state for which taxes will be withheld.

Clear Payroll State 2 if necessary. There can be no entry in Payroll State 2.

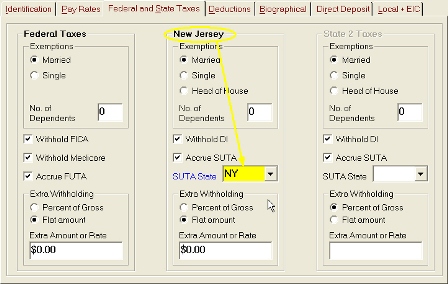

Click on the Federal and State Taxes tab.

Go to the SUTA State area of the [name of Payroll State 1] Taxes area.

Type or select the state for which SUTA is to be accrued from the list in the SUTA States drop-down box. This will be a different state than Payroll State 1.

Press the Save button, or choose File | Save.

Following these steps ensures that the employee’s income for State Withholding purposes is reported in one state, and his income for SUTA purposes is reported in the other.