|

|---|

|

| Store | company info | contact us | customer login | view cart |

This is the most common method of recording payroll. You are given time cards, a Payroll Input Sheet, or other listing showing what each employee has earned and you enter it.

Use this method whenever any employee has nonstandard earnings or deductions, reports tips or earns a bonus, and for all 1099 employees and 3rd parties. This method performs all withholding calculations and all automatic deductions. You are able to change any of the deductions and withholdings except FICA and Medicare.

To begin chose the Calculations link.

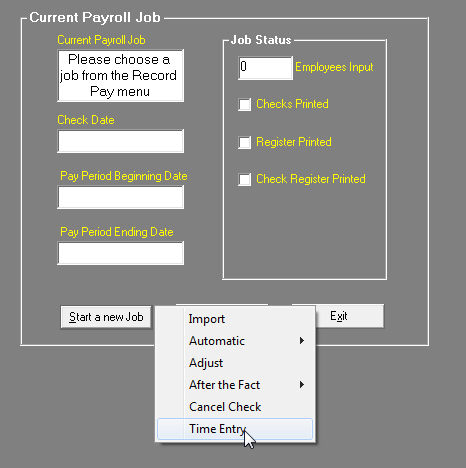

Select Time Entry from the menu.

Set the Hash totals if desired.

You work with the Payroll Recording Window.

Retrieve the employee to be processed.

If you don’t want to pay this employee, press New again.

Enter the earnings. Industrial Strength Payroll has already completed the amount for the first pay field. If incorrect, simply navigate to the field and make any changes. Each of the other fields can accept units, such as hours, or money.

Enter any non-standard deductions or reimbursements as needed. Click beside the field and enter the value.

Press Compute when you finish the input for this employee.

Industrial Strength Payroll computes the withholdings and applies any standard deductions from the Employee Master File. It then shows you the results and waits for your confirmation.

Review the information on the screen.

If you don’t want to pay this employee, press New.

If it is correct, press Post to accept. The employee’s records are updated.

If it is incorrect navigate to and change the error, and press Compute again.

![]()

The automatic deductions have already been computed. Because you might want to change a deduction, they are NOT recomputed. So, if you change any of the hours or earnings, and you have deductions that are based on hours or earnings, these deductions will NOT be updated. They may be incorrect as a result.

Therefore, whenever you have a situation where you have to change earnings for an employee with rate-based deductions, click New and retrieve the same employee again.

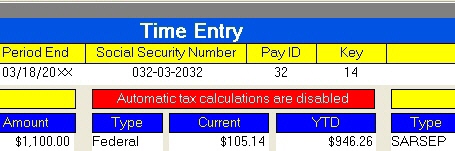

To change any tax, except FICA and Medicare, click Edit. This stops all withholding calculations except FICA and Medicare. The Taxes label becomes a warning message.

Click on the tax you want to change, change it and press Compute.

If it is correct, press Post to accept. The employee’s records are updated.

Press Stop at any time to end input.

Once done you can print checks, registers and General Ledger postings.